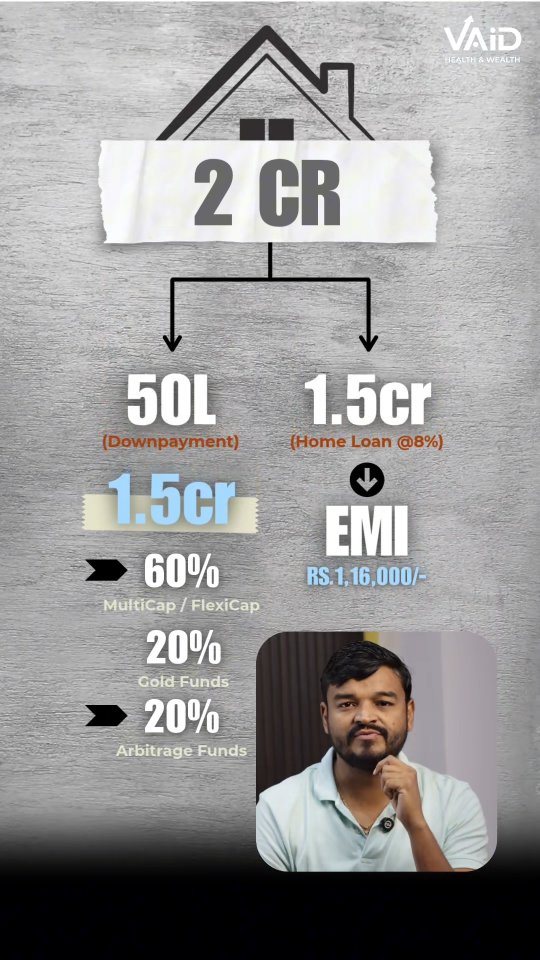

Top 3 Funds to Pay Off Your Home Loan EMIs 💰🏠 Never buy a house *entirely* with cash! Here's a smarter way: Let’s say you have ₹2 Crore and you want to buy a house worth ₹2 Cr. Instead of paying full cash, take a **home loan at 8% interest**. Put ₹50L as down payment and take ₹1.5 Cr loan. Your EMI for 25 years = approx ₹1.16L/month. Now invest your ₹1.5 Cr in **3 mutual funds** and start a **monthly SWP of ₹1.24L** (to cover EMI + tax). If your portfolio earns just **12% annually**, by the end of 25 years, your home loan will be paid off *and* you'll still have **₹6.38 Crores**! 💡 Fund Allocation: 🔹 60% in Diversified Equity Fund (Flexi-cap or Multi-cap) 🔹 20% in Gold Fund 🔹 20% in Arbitrage Fund 📊 When markets fall → increase equity allocation 📈 When markets rise → shift more to arbitrage Save this post 📌 Follow for more smart financial hacks 💼 Drop a comment if you want your personalised plan 👇 \#HomeLoanHacks #MutualFundStrategy #SWPStrategy #HomeBuyingTips #SmartInvesting #WealthCreation #FinancialFreedom #LoanPlanning #MoneyTips #InvestSmart

This post was published on 06th August, 2025 by Vikas on his Instagram handle "@vikasvaid_vhw (Vikas Vaid)". Vikas has total 84.3K followers on Instagram and has a total of 401 post.This post has received 39 Likes which are greater than the average likes that Vikas gets. Vikas receives an average engagement rate of 0.04% per post on Instagram. This post has received 0 comments which are lower than the average comments that Vikas gets. Overall the engagement rate for this post was lower than the average for the profile. #WealthCreation #HomeBuyingTips #InvestSmart #FinancialFreedom #SWPStrategy #SmartInvesting #MoneyTips #LoanPlanning #MutualFundStrategy #HomeLoanHacks has been used frequently in this Post.